What is monopolistic competition?

Monopolistic competition is a market structure in which many sellers provide differentiated products to many buyers. It is one of the realistic types of market structure. Sellers engage in advertising to highlight why their products are not the same as competitors’ products. Since each has its own brand, it has control over the prices charged.

Features of monopolistic competition

Relatively low barriers to entry and exit

The barriers to entry and exit are surmountable such that many firms join the industry in the long run. The barriers include significantly lower unit cost, patents, sunk costs, huge capital requirement and exclusive access to inputs or components.

Many firms and many buyers

The existence of low barriers allows more firms to enter the market. In other words, it is relatively easy to set up a business in this market. This is similar to what is obtainable in perfect competition even though the number of players is not infinite.

Differentiated products

The products sold are not homogeneous. Each firm sells a product that is slightly different from those of its competitors. Each firm has its own brand which is often reinforced with advertising.

Control over price

Each firm can exercise some control over the price it charges for its product even though it has a very small market share. Since the products are not homogeneous, each firm can dictate its own price regardless of the prices others fix. The market participants are price makers because each of them can independently make its pricing decision.

Profit maximiser

The objective of the firms in a monopolistic competitive market is to maximise profit. This is achieved when the marginal revenue and marginal cost are equal. But a firm can only make an abnormal profit in the short run. The abnormal profit will attract more firms into the market which results in the generation of a normal profit in the long run.

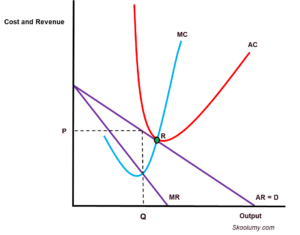

Short-run equilibrium in monopolistic competition

The firm produces at the output level where marginal revenue (MR) and marginal cost (MC) are equal. The average cost (AC) is below the average revenue (AR) leading to an abnormal profit in the short run. In Figure 1 below, the output Q occurs where MR is equal to MC as a profit maximiser. The rectangle PRST represents the abnormal profit made as the AR is greater than the AC.

Figure 1: Short-run equilibrium of a monopolistic competitive firm

Long-run equilibrium in monopolistic competition

In the long run, however, normal profit is made as AC and AR are equal (Figure 2 below). The relative ease of entry makes the short-run abnormal profit disappear in the long-run.

Figure 2: Long-run equilibrium of a monopolistic competitive firm

Efficiency in monopolistic competition

Monopolistic competition, an imperfect market structure, does not attain any type of efficiency. Productive and allocative efficiency do not exist in both the short- and long-run. In addition, dynamic efficiency cannot be attained since the short-run abnormal profit can be competed away in the long-run; the low barriers in a monopolistic competitive market mean that the firms cannot make an abnormal profit in the long-run to embark on innovation, research and development which are required to achieve dynamic efficiency.

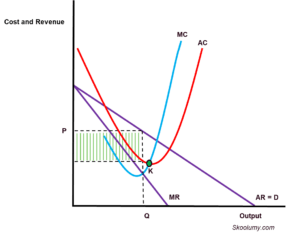

Efficiency in the short-run

A firm in a monopolistic competitive market does not attain productive and allocative efficiency in both the short-run. It does not produce at the output level where the average cost is at the lowest,i.e. there is no productive efficiency. In Figure 3 below, the equilibrium output Q is not determined from the lowest point on the average cost curve (point K). Also, there is no allocative efficiency because the price and marginal cost curve do not intersect or meet at the profit-maximising output Q in the short-run (Figure 3 below).

Figure 3: Efficiency in monopolistic competition in the short-run

Efficiency in the long-run

In the long-run, the firm does not produce at Point R where productive efficiency is achieved (Figure 4 below). The price and marginal cost curve do not intersect at a point that can be traced to Q, the equilibrium output level, thereby making allocative efficiency impossible in this type of market efficiency.

Figure 4: Efficiency in monopolistic competition in the long-run