What is monopoly?

Monopoly is an extreme type of market structure in which one firm is in control of the whole market. This theoretical type of market in which the firm has a market share of 100% is referred to as pure monopoly. Pure monopoly is unrealistic; what is obtainable is a situation where a dominant firm owns a substantial market share that confers on it the power to control price or output. A natural monopoly occurs when it is not cost-effective to have more than one supplier of a product, e.g., electricity distribution, gas distribution, rail transportation, water distribution, etc.

Features of a monopoly

One seller of a unique product

This market structure is made up of only one firm that sells a unique product to many buyers. The firm has no competitors and its product has no competing brands or close substitutes.

Profit maximising objective

The monopolist maximises profit, i.e., makes the highest amount of profit possible by producing at the level where marginal revenue and marginal cost are equal. Marginal revenue is the change in total revenue when a firm produces an extra unit of output, while marginal cost is the cost associated with making one more unit of a product.

Substantial barriers to entry and exit

The high barriers associated with this type of market make it difficult for any firm to join in order to share in the abnormal profits enjoyed by the monopolists. This is in contrast with a perfect competition where the absence of barriers truncates the short-run abnormal profit as more firms enter the market. For example, there may be a legal protection for a firm in form of patents that prohibits others from copying its invention. A long-established company may have a lower cost per unit due to large-scale production; because of its lower cost, it may make its price so low that other firms are discouraged from entering the market. The ownership of key inputs or huge capital requirements also constitutes entry barriers.

Asymmetric information

The monopolist has more information about the market than the consumers. He is more informed on the product, output and prices. Consequently, it exploits the information gap for its benefit. Asymmetric information leads to misallocation of resources as the consumers may end up paying too much for the product. Besides, the price in a monopoly is higher than the price in a perfectly competitive market. The quantity in a monopoly is, however, lower than the perfectly competitive market quantity.

Market power

The monopolist exercises considerable market power and can influence the price charged for the product. In perfect competition, firms cannot influence prices because consumers are aware of the market price and the firms are selling exactly the same product.

Short-run and long-run equilibrium in a monopoly

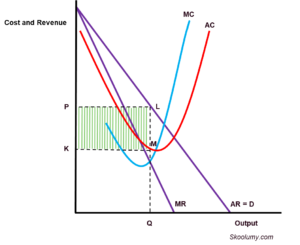

The equilibrium level of output in a monopoly is the output at which the marginal revenue is equal to the marginal cost. This is the profit-maximising output level that yields abnormal profit both in the short run and long run (rectangle PLMK in Figure 1 below).

In perfect competition, the short-run abnormal profit disappears in the long run due to the attraction of rivals to the market. Abnormal profit cannot disappear in the long run in a monopoly owing to the existence of substantial barriers to entry and exit. Abnormal profit, normally, occurs when average revenue is greater than average cost as shown in the diagram below.

Figure 1: Short-run and long-run equilibrium of a monopolist

Why is monopoly advantageous?

Profits for expansion

The monopolist generates a lot of revenue and profit because it is the sole supplier in the market. As a result, it has the resources to expand its business by setting up more branches and financing the acquisition of other businesses.

Economies of scale

A monopolist’s unit cost is lower than that of a new firm because it produces on a large scale, being the only firm in the market. For example, its marketing cost is spread over a large output, resulting in low marketing cost per unit. This improves the company’s profitability. Consumers can also benefit if the monopolist decides to charge a lower price due to reduced costs. Natural monopolies may provide essential utilities at a reduced cost to a large number of customers.

Better products due to research and development

Since a monopolist makes abnormal profit both in the short run and long run, it can afford to invest in research and development (R&D). R&D ensures that the monopolist achieves dynamic efficiency through innovative products and processes. This can result in the creation of products with improved quality. This increases consumer satisfaction. Perfectly competitive firms lack the financial strength to invest in R&D because their abnormal profit is always short-lived.

Absence of duplication

There is no wasteful duplication of goods and services. There are no multiple brands of the same product competing in the market for consumers’ attention. Each producer does not need to invest in separate land, capital, labour and enterprises. It frees up resources for use in other productive activities. Advertising and marketing costs by different producers are unnecessary since there is a unique product.

Why is monopoly disadvantageous?

Higher prices

The monopolist can raise prices to make fantastic profits. The goods sold have no alternatives so consumers have no choice. The price is higher as there are no substitutes. The quantity can also be restricted to ensure the price is kept as high as possible. This is why monopoly causes market failure; consumers do not purchase the required quantity owing to the high price. Consequently, welfare is lost.

No consumer choice

The consumers have no choice as there are no substitutes. They cannot choose from the variety of brands like in monopolistic competition where many firms sell differentiated products. Consumers have to buy the product, especially if it is essential.

Diseconomies of scale

The monopolist is the only one in the industry. Its large size may lead to a rise in average cost. This is referred to as diseconomies of scale. e.g., communication problem, difficulty in coordinating its activities.

X-inefficiency

The lack of competition makes the company complacent. It may not strive to improve its operations to give consumers better quality products as there are no competing brands. It may even decide not to innovate despite having a large amount of profit.

Efficiency in monopoly

There is hardly any type of efficiency in an imperfect market structure. Both productive and allocative efficiency are lacking in all types of imperfect market structures. Monopolists can only achieve dynamic efficiency out of the three types of efficiency being considered. They can attain dynamic efficiency because their abnormal profits cannot be competed away; the substantial barriers in a monopoly mean that the dominant firm can generate abnormal profits all the time and have enough to embark on innovation, research and development which are the hallmarks of a firm that can achieve dynamic efficiency.

Efficiency in the short-run and long-run

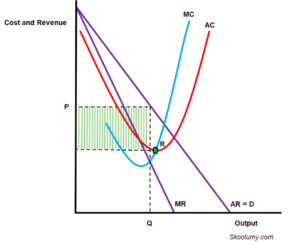

The monopolist is the only firm in the industry in the short- and long-run. It does not produce at the lowest point on the average cost curve (corresponding to point R in Figure 2 below) or where the price and marginal cost curve meet. In other words, it can neither be productively efficient nor allocatively efficient in the short- and long-run.

Figure 2: Short- and long-run efficiency in monopoly

However, the existence of abnormal profit all the time assures that the firm has ample funds to invest in technology and research and development; it, therefore, can attain dynamic efficiency. This will lead to a fall in the firm’s long-run average cost. It is beneficial to the consumers as they have access to innovative products and can enjoy lower prices if the monopolist decides to pass the gains of lower long-run average cost to them.